Adjudication and Compounding of offences under Companies Act, 2013 in Tamil

- Tamil Tax upate News

- October 5, 2024

- No Comment

- 171

- 21 minutes read

Indian Corporates have completed 10 years of journey under the Companies Act, 2013. With this, Ministry of Corporate Affairs (MCA) has taken serious measures for implementation of compliances under the act very strictly. Any non-compliances or deviations will ultimately lead to adjudication and compounding of offences under the Companies act, 2013.

In this attached presentation, we have made an attempt on various provisions relating to Adjudication and compounding of offences under the Companies act, 2013.

Discussion points

1. Background

2. Important Concepts

3. Officer-in-default

4. Non –Compoundable offences

5. Compoundable offences

6. Adjudication matters & e–adjudication

7. Compounding of offences & Condonation of delay

8. Punishment for fraud

9. Double penalties for repeated offence

10. Lesser penalties for smaller companies

11. MCA CMS

12. Special Courts

13. Limitation period

14. Key Take aways

Background

Consequences of non – compliances

√ Additional fee while filing the information / document;

√ Adjudication / compounding / condonation of delay and prosecution

√ Attract penal provision under respective sections

√ Reputational damage

√ Cost of non-compliances is more than the cost of compliance

√ Certain non-compliances triggers dis-qualifications (schedule V)

√ Disclosure of non-compliance by the company in form MGT 7

√ Reporting of non-compliance by PCS issuing Form MGT.8, Secretarial Auditor issuing Form MR.3 and Statutory Auditor issuing audit report

√ Reporting of non-compliances in Board report

–

Important Concepts

- Meaning of ‘Default’ as per Black’s Law Dictionary, an omission that which ought to be done. Specifically, the omission and failure to perform legal duty.

- Under the Companies Act, 2013, “default” refers to a failure by a company to comply with legal requirements or obligations.

- Meaning of ‘Offence’ as per CrPC, any act or omission made punishable by any law for the time being in force.

- An act or behavior prohibited by criminal law and therefore punishable by law: fines, imprisonment, additional sentences, etc.

Comparison

Default refers to a failure to meet legal or contractual obligations, such as non-compliance with regulatory requirements. An “offence,” on the other hand, involves a violation of criminal law that is punishable by penalties or imprisonment. While default pertains to breaches of civil or administrative duties, an offence specifically involves criminal conduct.

In the Companies Act, 2013, penalty is meant for civil default. Fine is meant for criminal offences. Penalty is adjudicated in house. Fine will be imposed by the Court or compounded by the NCLT/RD.

- Cognizable and non cognizable Offence

Cognizable offences are those in which a police officer can arrest a person without the need for a court order. Non-cognizable offences are those where the police officer needs court permission to arrest a person

- “Ignorantia juris non excusat”

Ignorantia juris non excusat is a Latin phrase that means “ignorance of the law excuses no one.” This means that not knowing about a law or rule is not a excuse for breaking it.

Officer in default – Section 2(60)

Officer: Section 2(59) : includes Director, Manger, KMP or person charged

Officer who is in default: Section 2(60): Means any of the following officers

i. Whole – time Director (WTD)

ii. Key Managerial Personnel (KMP)

iii. Where no KMP – Directors who had consented, if no director consented, all directors.

iv. Other persons charged with responsibility with respective section(s)

v. Any person on whose advise, directions and instructions, the Board is accustomed to act.(professional advise is excluded)

vi. Every director who is aware of such contravention by virtue of receipt of minutes or has participated without objecting, or consented or connivance

vii. STA, Registrars , Merchant bankers to the issue in case of transfer of shares

Persons covered other than Officer-in-default

The following sections covers persons other than Officer-in-default:

Case

M/s. XYZ Private Limited has 3 executive directors namely A, B and C. The Board of directors nominated Mr. A, one of the executive directors for compliances under CA 2013 who will act as Officer in Default.

ROC has issued notice to all 3 directors for violation of Section 12 under the act.

The Board says only ‘A’ is only liable as officer in default.

Is it Correct?

Answer: No, when the Company has WTD, all are liable for consequences

De-criminalization

What is De-criminalization?

- A process which removes prosecutions against an action so that the action remains illegal but has no criminal penalties or at most some civil fine.

- The goal is to create a system in which sanctions are imposed rather than criminal processes, with the latter reserved for significant contraventions.

Brief history of de-criminalization

- Joint Parliamentary Committee on Stock Market Scam – identified that penal liabilities under Companies Act 1956 (CA 1956) were very nominal and easily compoundable

- Companies Act 2013 (CA 2013) introduced “serious offenses” and established Special Courts to try them

- Companies (Amendment) Act 2017 (CAA 2017) made “all offenses” to be tried by Special Courts

- Report of Committee to Review Offenses under CA 2013.

- Companies (Amendment) Ordinance 2018 and Companies (Amendment) Act 2019 (CAA 2019) w.e.f. 02.11.2018

- Companies (Amendment) Act 2020 (CAA 2020) w.e.f. 22.01.2021

Criminalized penal provision

Non – Compoundable offences

Non compoundable offences where prosecution is mandatory

üProviding false or incorrect information or hiding important details when filing a form. If it’s discovered after incorporation that the company was set up fraudulently. (Section 7)

√ When affairs of company conducted fraudulently. (Section 8[11])

√ Prospectus includes statement which is untrue or misleading. (Section 34)

√ Making false statement knowingly and misleading others to enter into agreement. (Section 36)

√ With an intent to defraud issues a duplicate certificate. (Section 46[5])

√ Depository/ Depository participant with an intent of defraud. (Section 56[7])

√ Person deceitfully represent as an owner of security – Personation. (Section 57)

√ Refusal of registration and appeal against refusal. (Section 58)

√ Contravention of manner or condition prescribed under section 73 or 74.

Non – Compoundable offences (Ctd…)

> Proved that deposit has been accepted with intent of defraud and default in repayment or payment of interest. (Section 75)

> Willfully furnishes false or incorrect information, suppress material info, required to be registered in accordance with S 77. (Section 86[2])

> Tampering with minutes of proceeding of meeting. (Section 118[12])

> Dividend declared but not paid within 30 days. (Section 127)

> Auditor of company has acted fraudulently or colluded in a fraud. (Section 140[5])

> Contravention of Prohibitions and restrictions regarding political contributions. (Section 182)

> Contravention of provisions of Loan and investment by company. (Section 186)

> Registered Valuers – Valuer has contravened with an intention to defraud. (Section 247)

> Any person makes statement which is false materially or omits any material fact knowingly. (Section 448)

Compoundable offences Section 441

- Fails to repay deposit or interest within the time. (Section 74)

- Default in holding a meeting in accordance with section 96-98. (Section 99)

- Contravention of provisions of Books of account, etc., to be kept by company. (Section 128)

- Contravention of provisions of Financial statement. (Section 129)

- Contravention of provisions of Duties of Directors. (Section 166)

- If a person functions as director even when he knows that the office of director held by him has become vacant on account of disqualification. (Section 167)

- Loan is advanced or guarantee given in contravention of Section 185.

Matters which are subject to adjudication

√ Failure/delay in filing a notice for alteration of share capital u/s. 64

√ Failure/delay in filing an annual return U/s 92

√ Failure/ delay in filing certain resolutions u/s 117

√ Failure/ delay in filing financial statements u/s 137

√ Failure/delay in filing statement by the auditor after the resignation u/s 140(3)

√ Accepting directorships beyond specified limits U/S165(6)

√ Violation of CSR provisions u/s 135

√ Violation of related party transactions U/s 188

ADJUDICATION (Section 454)

What is Adjudication?

- the process or act of making an official decision about something, especially about who is right in a disagreement:

- Adjudication refers to the regular process of issuing a notice, hearing and passing an order for penalty under relevant provisions of the act.

Who is an Adjudicating officer?

- Adjudicating officer appointed by Central Government u/s 454 read with rule 3(1), The ROC has been shouldered with the responsibility of AO.

Background of adjudication process

CA 1956 v/s. CA 2013

Non-compoundable offences

CG may by an order appoint a person not below the rank of Registrar, as adjudicating officers for adjudging penalty adjudicating officer may by an order

a. impose the penalty on the company, the officer who is in default, or any other person, as the case may be, stating therein any non-compliance or default under the relevant provisions of this Act; and

b. direct such company, or officer who is in default, or any other person, as the case may be, to rectify the default, wherever he considers fit.

officer who is in default

Reasonable opportunity of being heard to such company.

Non – compliance related to u/s 92 or 137

- Special provisions for non-compliance u/s 92 and 137 ( Proviso to section 454)

- Any default that has been rectified either prior to, or within thirty days of, the issue of the notice by the adjudicating officer, no penalty shall be imposed in this regard and

- all proceedings under this section in respect of such default shall be deemed to be concluded.

Powers of Adjudicating officer

A.O can summon any person and enforce the attendance of any person

order for evidence or to produce any document

AO may pass an order imposing the penalty If any person fails to reply or neglects or refuses to appear

A.O shall have due regard to the following factors, namely:-

a. size of the company

b. nature of business carried on by the company;

c. injury to public interest;

d. nature of the default;

e. repetition of the default;

f. the amount of disproportionate gain or unfair advantage, wherever quantifiable, made as a result of the deflate: and

g. the amount of loss caused to an investor or group of investors or creditors as a result of the default:

Provided that, in no case, the penalty imposed shall be less than the minimum penalty prescribed, if any, under the relevant section of the Act.

e-Adjudication

- All proceedings of Adjudicating officer and Reginal Director shall take place on such as including issue of notices, filing replies, or documents, evidences, holding of hearing, attendance of witnesses, passing of orders and payment of penalty shall be only on electronic mode

- Officer and Regional Director under these rules shall take place in electronic mode only through the e-adjudication platform developed by the Central Government for this purpose.

W.e.f. 16th September, 2024

Process of e-Adjudication

–

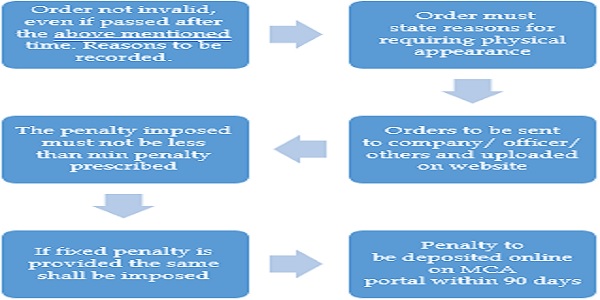

Procedure for Adjudication

- ROC issues notice (or) Filing of Form GNL.1 voluntarily

- After giving reasonable opportunity of being heard, Adjudicating Officer will pass an order.

- After Adjudicating officer passes order, next we can appeal to Regional Director.

Whether ROC has power to vary the penalty?

““liable to a penalty of ….. rupees”” (section 105(3))

“…shall be liable to a penalty which may extend to an amount equal to …… OR …… rupees which ever is less” (section 53(3))

“…shall be liable to a penalty of … rupees for each day during which such default continues but not exceeding an amount of … rupees” (section 10A(2))

“… shall be liable to a penalty of … rupees for each day during which such default continues, or …. rupees whichever is less.” (section 64(2))

“shall be liable to a penalty of ….. rupees and in case of continuing failure, with a further penalty of …. rupees for each day after the first during which such failure continues, subject to a maximum of … rupees (section 92(5))