Analysis of Notifications and Circulars for Week ending 22nd September 2024 in Tamil

- Tamil Tax upate News

- September 23, 2024

- No Comment

- 196

- 26 minutes read

During the week of September 16-22, 2024, several significant notifications and circulars were issued across various regulatory bodies in India. The Income Tax Department recognized Auroville Foundation for tax deductions related to research and announced the Direct Tax Vivad Se Vishwas (DTVSV) Scheme 2024, effective October 1, to settle pending income tax disputes. Monetary thresholds for filing appeals were revised. In GST, advisories were issued for reporting ITC reversals and a new Invoice Management System was introduced to streamline compliance. The Supreme Court ruled against collecting VAT dues from company directors, while the Punjab & Haryana High Court waived pre-deposit requirements in certain cases. In customs, amendments were made regarding laboratory chemicals and the implementation of automation for Export Oriented Units (EOUs) was postponed. The Directorate General of Foreign Trade (DGFT) updated import policies for fresh Areca nuts and modified the EPCG scheme to ease compliance burdens. SEBI facilitated T+2 trading for bonus shares and revised guidelines for mutual funds in Credit Default Swaps (CDS). Additionally, the Ministry of Corporate Affairs (MCA) mandated that private companies must dematerialize shares by September 30, 2024, and extended provisions for holding meetings via virtual means until September 30, 2025.

A. Income Tax

Auroville Foundation notified under section 35(1)(iii) as other institution for Research: The notification notifies Auroville Foundation as an ‘Other Institution’ for research I social science or statistical research for the purposes section 35(1)(iii) of the Income Tax Act, read with rules 5C and 5E of the Income Tax Rules. Section 35 allows for deduction while computing taxes for expenses relating to research. (Income Tax Notification 102/2024 Dated 18/09/2024)

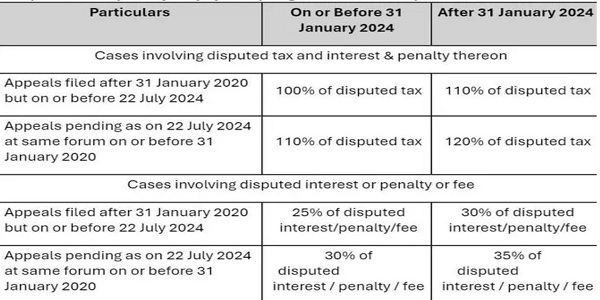

Direct Tax Vivad Se Vishwas (DTVSV) Scheme 2024 to come into force from 1st October 2024: The notification appoints the 1st day of October, 2024 as the date on which the Direct Tax Vivad Se Vishwas Scheme, 2024 shall come into force. The DTVSV Scheme, 2024 was enacted vide Finance (No. 2) Act, 2024, to resolve pending appeals in the case of income tax disputes. The amount required to be paid by rax payers opting to settle the disputes under the DTVSV scheme is as under:

(Income Tax Notification 103/2024 Dated 19/09/2024)

Direct Tax Vivad se Vishwas (DTVSV) Rules, 2024: The Rules and Forms for enabling the Scheme have also been notified. Four separate Forms have been provided as under:

Form-1: Form for filing declaration and Undertaking by the declarant

Form-2: Form for Certificate to be issued by Designated Authority

Form-3: Form for Intimation of payment by the declarant

Form-4: Order for Full and Final Settlement of tax arrears by Designated Authority

The detailed provisions of the DTVSV Scheme, 2024, may be referred to in section 88 to section 99 of the Finance (No. 2) Act, 2024 along with DTVSV Rules, 2024. (Income Tax Notification 104/2024 Dated 20/09/2024)

Revision in monetary limits for filing appeals by Income Tax department: The new monetary thresholds are set at Rs. 60 lakh for appeals before the Income Tax Appellate Tribunal, Rs. 2 crore for High Courts, and Rs. 5 crore for Supreme Court cases. Earlier the limit was Rs. 50 lakh for appeals before the Income Tax Appellate Tribunal (ITAT), Rs. 1 crore for High Courts, and Rs. 2 crore for Supreme Court cases. Exceptions to these limits, outlined in circular 5/2024 dated 15th March 2024, allow for appeals based on the merits of the case regardless of the tax amount involved. (Income Tax Circular 09/2024 Dated 17/09/2024)

HC, Denial of refund as tax deducted by Land Acquisition Collector not reflected in Form 26AS unjustified: Case of Hari Kishan Sharma vs Govt of NCT of Delhi, Delhi HC Judgement Dated 3rd September 2024. The Court held that deduction of tax by Land Acquisition Collector is duly deducted, however, the same was not reflected in Form 26AS. The petitioner cannot be penalized for mere reason that Form 26AS suffered from a discrepancy. (Delhi HC Judgement dated 03/09/2024)

B. GST

Advisory on Re-opening of Reporting ITC Reversal Opening Balance: To facilitate the taxpayers in correct and accurate reporting of ITC reversal and reclaim thereof and to avoid clerical mistakes, a new ledger namely Electronic Credit Reversal and Re-claimed Statement was introduced on the GST portal. The taxpayers were also given an opportunity to report their cumulative ITC reversal (ITC that has been reversed earlier and has not yet been reclaimed) as an opening balance. Now, the Taxpayers are being provided with one final opportunity to report their cumulative ITC reversal as opening balance from 15th September 2024 to 31st October 2024. The amendments in declared opening balance will be available till 30th November, 2024. (GSTN Advisory Dated 17/09/2024)

Advisory on Draft Manual on Invoice Management System: Invoice Management System (IMS) empowers taxpayers to seamlessly accept, reject, or keep invoices pending in the system to avail later as and when required, streamlining the reconciliation process, and ensuring greater accuracy and efficiency in GST compliance. It facilitate taxpayers in matching their records/invoices vis a vis issued by their suppliers for availing the correct Input Tax Credit (ITC). The detailed draft manual has been issued and the final version shall be published later. (GSTN Advisory Dated 17/09/2024 & Draft Manual)

Advisory on FAQs on Invoice Management System: Frequently asked questions (FAQs) on IMS has been issued to get a better understanding of the new functionality. (GSTN Advisory Dated 22/09/2024 & FAQs)

SC, VAT dues can not be collected from the directors of private company: Case of Shankar Rudra vs State of Uttarakhand, SC Order Dated 10th September 2024.The appellant, Shankar Rudra, a director of M/s. SLR Impex Private Limited, challenged a recovery notice issued for unpaid taxes under the Uttarakhand Value Added Tax (UVAT) Act. The Court held that the UVAT Act does not allow for the recovery of a company’s dues from its directors unless the company is in liquidation, as specified in Section 12(1) of the Act. Since no winding-up order was presented, the recovery notice issued to Rudra was deemed unjustified. SC allowed the civil appeal, and quashed the recovery notice. Consequently, the orders of the lower courts were set aside, reaffirming the principle that liability for tax recovery must align with established legal provisions. (SC Order Dated 10/09/2024)

HC, Waiver of Pre-Deposit Under HVAT Act: Case of Anand Rathi commodities vs state of Haryana, P&H High Court Judgement Dated 16/09/2024. The petitioners challenged the appellate authorities’ dismissal of their appeals due to non-furnishing of bank guarantees or adequate security, citing financial incapacity. The core question was whether appellate authorities had the power to waive the pre-deposit requirement. The High Court referred to prior rulings, including the Supreme Court’s judgment in M/s Tecnimont Private Limited, which allows for relief in cases of severe financial hardship. While the appellate authorities could not waive the pre-condition, the High Court exercised its writ jurisdiction to direct that the appeals be heard without insisting on pre-deposit, given the petitioners’ poor financial status. (P&H High Court Judgement Dated 16/09/2024)

HC, Taxpayer liable for statutory non-compliance even after GST registration cancellation: Case of Guruji Enterprises vs PCGST, Delhi High Court Judgement dated 2nd September 2024. The court held that cancellation of a tax payer’s GST registration does not absolve the tax payer from being held accountable for any statutory non-compliance or absolves it from any liability under the statute. (Delhi High Court Judgement Dated 02/09/2024)

AAR, Imported Goods Retains Initial Classification for GST: Case of Imtiyaz Kaiyum Barvatiya, AAR Gujarat Ruling Dated 3dr September 2024. The applicant imports various goods/spares. The central issue was whether the supply of certain marine equipment could be reclassified under specific GST entries to avail a 5% GST rate. AAR ruled that the supply of goods classifiable under the same chapter, under which the goods were imported and the rate of the supply off said goods would be in terms of the the rates applicable to such tariff entry under various tariff items. (AAR Gujarat Ruling Dated 03/09/2024)

AAR, Nonwoven PVC-Coated Fabrics falls Under Chapter 39, Attract 18% GST: Case of Om Vinyls Private Limited, AAR Gujarat Ruling Dated 6th September 2024. AAR ruled that the nonwoven coated fabrics -coated, laminated or impregnated with PVC will fall under chapter heading 39. The products (a) table cover, (b) television cover (c) washing machine cover, it would fall within the ambit of tariff item 392690 and would attract 18% GST, while bags would be classified under tariff item 3923 and would attract l8% GST. (AAR Gujarat Ruling Dated 06/09/2024)

C. Central Excise

Special Additional Excise Duty on domestically produced Petroleum Crude: Special Additional Excise Duty on domestically produced Petroleum Crude reduced from earlier Rs 1850/- to Rs NIL per tonne with effect from 18th September 2024. (Central Excise Notification 25/2025 (T) Dated 17/09/2024)

D. Custom Duty

Amendment definition of laboratory chemicals: The amendment pertains to Chapter 98 (note 3) of the Customs Tariff Act. The new definition of laboratory chemicals stipulates that it include all organic and inorganic chemicals that are either chemically defined or not, which are imported solely for personal use. Importantly, these chemicals must be packaged in quantities not exceeding 500 grams or 500 millilitres and must be identifiable based on their purity or markings that indicate their exclusive use as laboratory chemicals. (Custom Notification 62/2024 (NT) Dated 19/09/2024)

Implementation of automation in the Customs Rules in respect of EOUs: Vide Circular 11/2024 Dated 25th August 2024, CBIC had notified the implementation of automation for the Customs (Import of Goods at Concessional Rate of Duty or for Specified End Use) Rules, 2022, in respect of Export Oriented Units (EOUs) w.e.f. 1st September 2024, later extended to 17th September 2024. In view of the representations received regarding difficulties being faced by them in the implementation of the above module such as registration, generation of IIN details and the submission of bond details, the implementation of the same has been extended w.e.f. 25th September 2024. (Custom Circular 16/2024 Dated 17/09/2024)

Process of automated exchange rate publication: The Circular 07/2024 has been revised to enhance the automated exchange rate publication process. The updated procedures include provisions for publishing exchange rates on ICEGATE and integrating them into the ICES system, even if a due date (1st or 3rd Thursday) falls on a holiday or there is an API error. It is to ensure that the latest rates from the State Bank of India (SBI) are published by 6 PM on due dates, with manual updates if automatic integration fails. (Custom Circular 17/2024 Dated 18/09/2024)

E. Directorate General of Foreign Trade (DGFT)

Amendment in Import policy conditions of Fresh Areca Nuts from Bhutan: In addition to the existing two ports, import of 17,000 Metric Tonnes of Fresh (green) Areca nut without Minimum Import Price (MIP) condition from Bhutan shall also be allowed through LCS Hatisar and LCS Darranga. (DGFT Notification 30/2024 Dated 18/09/2024)

Amendment in EPCG Scheme to reduce ‘Compliance Burden’ and enhance ‘Ease of doing Business’: The exporters were required to submit an annual report on export obligation fulfillment by June 30 each year. The amended provision allows for the submission of this report only after the first block period of four years, with continuous reporting until the expiry of the valid export obligation period. The report must be submitted online and include detailed information such as shipping bill or invoice numbers, along with certification by a Chartered Accountant, Cost Accountant, or Company Secretary to verify compliance with export obligations. (DGFT Public Notice 24/2024 Dated 20/09/2024)

Amendments under Interest Equalisation Scheme: Interest Equalisation Scheme (IES) was extended up to 30th September vide Trade Notice no 16/2024 dated 31.08.2024. The annual net subvention amount is capped at Rs 10 Cr per IEC for a given financial year, accordingly a cap of Rs. 5 Cr per IEC for MSME manufacturers is imposed till 30.09.2024 for the financial year. (DGFT Trade Notice 17/2024 Dated 17/09/2024)

F. Securities and Exchange Board of India (SEBI)

Enabling T+2 trading of Bonus shares where T is the record date: The circular mandates a reduction in the time for trading of bonus shares from the record date. Issuers must apply for approval of the bonus issue within five working days of the board meeting and fix the record date, with the deemed date of allotment being T+1. Stock exchanges will notify the record date and allotment date, while issuers are required to submit documents to depositories by noon the next working day (T+1). Bonus shares will be available for trading on T+2. Additionally, the requirement for temporary ISINs for bonus shares is exempted, allowing direct credit into the permanent ISIN. (SEBI Circular Dated 16/09/2024)

Modification in framework for valuation of investment portfolio of AIFs: The valuation of securities not covered under specific provisions must follow guidelines endorsed by an AIF industry association representing at least 33% of registered AIFs. SEBI extended the timeline for AIFs to report valuation data based on audited accounts of investee companies from six to seven months. The changes also include harmonizing valuation norms for thinly traded and non-traded securities by March 31, 2025. The circular clarifies that any changes in valuation methodology or approach will not be considered a “Material Change,” but transparency must be maintained through investor disclosures. (SEBI Circular Dated 19/09/2024)

Flexibility in participation of Mutual Funds in Credit Default Swaps (CDS): The mutual funds could only use CDS to hedge against credit risks on corporate bonds as at present. The updated regulations now allow them to buy and sell CDS as an additional investment option. This change aims to enhance liquidity in the corporate bond market. The circular outlines various conditions, including exposure limits, requirements for investment-grade ratings, and risk management protocols. (SEBI Circular Dated 20/09/2024)

Standard Operating Procedure (SOP) for payment of Financial Disincentives by Market Infrastructure Institutions (MIIs) as a result of Technical Glitch: SOP has been revised related to financial disincentives imposed on MIIs due to technical glitches. The previous policy allowed penalties to be levied on individuals, such as the Managing Director (MD) and Chief Technology Officer (CTO). However, SEBI has decided to limit these disincentives to the MIIs themselves, considering the complexities of modern MII operations, which rely heavily on various IT systems and vendors. MIIs are required to monitor their systems and pay disincentives for downtime beyond a specified threshold. (SEBI Circular Dated 20/09/2024)

Amendment to Issue and Listing off Non-Convertible Securities Regulations: The key amendments include, the timeframe for issuers to post draft offer documents has been reduced from seven working days to five, and electronic modes of advertisement have been expanded to include online platforms. Also, the issuers must now publish a notice in national and regional newspapers with a QR code linking to the full advertisement. It also stipulate that details of branches may be provided via static QR codes, ensuring better accessibility to information for stakeholders. (SEBI Notification Dated 17/09/2024)

Consultation Paper on allowing only electronic mode for payment of dividend or interest or redemption or repayment amounts: While electronic payment methods are encouraged, there are provisions allowing physical payments via warrants or cheques if electronic payment fails or bank details are incorrect. Data shows that 1.29% of electronic dividend payments have failed in demat accounts due to such issues. This amendment aims to mandate that all payments related to dividends, interest, redemptions, or repayments be conducted exclusively through electronic modes. (SEBI Consultation Paper Dated 20/09/2024)

G. Ministry of Corporate Affairs (MCA)

Amendment to Companies (Prospectus and Allotment of Securities) Rules: It relate to sub-rule (2) of Rule 9B, which mandates that all private companies, except small companies must dematerialise their shares by September 30, 2024. The amendment adds a proviso stating that producer companies under this rule must comply with the provisions within five years of the closure of the financial year. (MCA Notification Dated 20/09/2024)

Holding of EGM via VC/OAVM and Postal Ballot extended till 30th Sept 2025: The circular clarify the procedures for holding Annual General Meetings (AGMs) and Extraordinary General Meetings (EGMs) via Video Conference (VC) or Other Audio Visual Means (OAVM). The extension allows companies whose AGMs are due in 2024 or 2025 to conduct these meetings through VC or OAVM by September 30, 2025. Additionally, the holding of EGMs and the use of postal ballots is permitted until the same deadline.

— However, this extension does not alter the statutory deadlines for holding AGMs, and companies failing to meet these timelines may face legal repercussions under the Companies Act, 2013. (MCA General Circular 09/2024 Dated 19/09/2024)

H. Insolvency and Bankruptcy Board of India (IBBI)

SC, Covid-19 lockdown a valid reason for extension of time to deposit the balance sale consideration: (Case of VS Palanivel vs P Sriram, SC Judgement Dated 28th August 2024) Supreme Court held that Covid-19 lockdown was a valid reason for extension of time to deposit the balance sale consideration to auction purchaser under Insolvency and Bankruptcy Code. The appeal is partly allowed. (SC Judgement Dated 28/08/2024)

IBBI suspends registration of IP Pramod Kumar Sharma for due diligence and violation of multiple provisions of IBC: The committee found that he failed to pay required lease rents, resulting in termination of the lease agreement, and did not press for timely disposal of the resolution plan approval application. The findings concluded that he contravened several provisions of the Code and applicable regulations, raising questions about his compliance with professional conduct standards. IBBI suspended the registration of Mr. Pramod Kumar Sharma for a period of three years. (IBBI Order Dated 20/09/2024)

RTI, Obligation to provide only factual information within the records, not the opinions or advice: The appellant had enquired about measures for operational creditors during the insolvency process. He sought information on amendments, changes to IBC, and steps to support operational creditors. The IBBI had responded that the requested information involved opinions and clarifications, which do not fall under the definition of “information” as per the RTI Act. The First Appellate Authority reviewed the appeal and confirmed that the RTI Act does not obligate public authorities to provide opinions or advice, only factual information within their records. The appeal was dismissed. (IBBI RTI-FAA Order Dated 18/09/2024)

RTI, Limited to existing Information only, not extends to creation of new data or interpretations: The appellant challenged the IBBI response to his RTI application seeking the status of a grievance, that the matter was still under examination. In his appeal, the appellant cited sections of Grievance and Complaint Handling Regulations, which mandate grievance resolution within 30 days. The First Appellate Authority clarified that the RTI Act is limited to providing material information already available and does not extend to creating new data or offering interpretations. The appeal was dismissed. Any issues with the grievance procedure must be handled outside of the RTI Act. (IBBI RTI-FAA Order Dated 18/09/2024)

I. Reserve Bank of India (RBI)

Designated List Amendments, Implementation of Sec 12A of the WMD Act: MEA has informed that the UNSC Committee has enacted the amendments, in certain entries on its Sanctions List of Designated Individuals and Entities. Regulated Entities (REs) are advised to take note for necessary compliance in terms of Master Directions on KYC. (RBI notification 75/2024 Dated 19/09/2024)

Interest Equalization Scheme on Pre and Post Shipment Rupee Export Credit: Interest Equalisation Scheme for Pre and Post Shipment Rupee Export Credit was extended up to 30th September applicable only for MSME manufacturer exporters. The annual net subvention amount is capped at Rs 10 Cr per IEC for a given financial year, accordingly a cap of Rs. 5 Cr per IEC for MSME manufacturers is imposed till 30.09.2024 for the financial year. (RBI notification 76/2024 Dated 20/09/2024)

J. Miscellaneous

SC, Employee withdrew resignation before its acceptance by employer, ordered reinstatement: Case of SD Manohara vs Konkan Railway Corporation, SC Judgement Dated 13th September 2024. The court examined the matter in detail, and concluded that the resignation was in fact withdrawn before its acceptance. SC thus allowed the appeal and directed reinstatement of the appellant. Further, to balance equities, the court ordered the salary payable for the period that the appellant has not worked to be restricted to 50% of the salary payable for the said period. (SC Judgement Dated 13/09/2024)

*****

Disclaimer: The contents of this article are for informational purposes only. The user may refer to the relevant notification/ circular/ decisions issued by the respective authorities for specific interpretation and compliances related to a particular subject matter)