Section 56(2)(vii)(b) Addition without reference to valuation officer’s is legally unsustainable: ITAT Lucknow in Tamil

- Tamil Tax upate News

- November 2, 2024

- No Comment

- 4

- 44 minutes read

Nirmal Singh Vs ITO (ITAT Lucknow)

ITAT Lucknow held that addition under section 56(2)(vii)(b) of the Income Tax Act without reference to Valuation Officer, as mandated by law, has not legs to stand and hence is unsustainable in law.

Facts- The assessee had filed the return of income on 30/09/2014, showing total income of Rs.7,81,320/-. Subsequently, notice dated 30/03/2021 was issued u/s 148 of the Act, in compliance whereof the assessee again filed income tax return on 22/04/2021; declaring income of Rs.7,81,320/-again. Vide assessment order dated 30/03/2022 passed u/s 147 r.w.s 144B of the Act, the assessee’s total income was assessed at Rs.2,71,15,320/-. In the aforesaid assessment order, an addition of Rs.2,14,22,053/- was made u/s 56(2)(vii)(b) of the Act and an addition of Rs.49,11,947/- was made towards Short Term Capital Gain (STCG).

CIT(A) dismissed the appeal. Being aggrieved, the present appeal is filed.

Conclusion- The provisions of Section 50C(2) of the Act as well as proviso to Section 56(2)(vii)(b) of the Act; mandate reference by the Assessing Officer to the Valuation Officer when the assessee claims before the Assessing Officer that the value adopted or assessed or assessable Stamp Valuation Authority exceeds the fair market value of the property as on the date of transfer.

Held that the additions made by the Assessing Officer amounting to Rs.2,14,22,053/- and Rs.49,11,947/-, as aforesaid, without reference to the Valuation Officer as mandated by law, has no legs to stand and is unsustainable; having regard to applicable law as well as facts and circumstances of the present case before us. Accordingly, we set aside the impugned appellate order dated 03/01/2024 of the Ld. CIT(A) and we direct the Assessing Officer to delete the aforesaid additions of Rs. 2,14,22,053 and Rs. Rs.49,11,947/-.

FULL TEXT OF THE ORDER OF ITAT LUCKNOW

The present appeal as well as the stay application has been filed by the assessee against the order passed by the Ld. Commissioner of Income Tax (Appeals) [hereinafter “the Ld. CIT(A)”]/NFAC u/s 250 of the Income Tax Act, 1961 (hereinafter “the Act”) dated 03/01/2024 for the assessment year 2014-15.

2. The grounds of appeal of the assessee are as under: –

“1. Because the reassessment proceedings initiated, notice issued u/s. 148 and the re-assessment framed, are all without jurisdiction bad in law be quashed.

2. Because the entire reopening having been done based on borrowed satisfaction, bereft of any independent investigation/enquiry by the AO, lacking satisfaction, the notice issued u/s.148 and the reassessment framed thereafter are all contrary to the provision of law and be quashed.

3. Because there being no material to form reason to believe that income has escaped assessment, the reassessment framed under section 147 read with section 144B is bad in law void ab initio and be quashed.

4. Because there being no approval as mandated as per section 151, from the Chief Commissioner of Income-tax, the notice issued under section 148 is without jurisdiction, the reassessment framed be quashed.

5. Because the CIT(A) has erred on facts and in law in upholding the addition of Rs.2,14,22,053/- u/s 56(2)(vii) of the Act, on account of difference between the stamp value and the actual consideration paid, on account of purchase of property, on account the addition being contrary to the provisions of law the same be deleted.

6. Because the CIT(A) has erred on facts and in law overlooking that there being first a verbal agreement on 10/03/2011 and thereafter a – registered agreement executed on 03/07/2012 to purchase the property, which having being acted upon in as much as part consideration having being paid was not justified in adopting the stamp duty value of Rs.4,82,73,484/- as the sale consideration as against Rs.2,19,40,000/- the agreed purchase consideration, paid by the assessee in terms of the said agreement, the addition made by the AO and upheld be deleted.

7. Because the Ld. CIT(A) in his Appellate Findings in the order issued u/s 250 of the act mentions as here under:

“4.5 As regards, in the next ground, the sale at a low consideration is concerned. The AO has invoked Section 56(2)(vii). This section pertains to the tax implications of transactions where immovable property is transferred for a consideration less than its stamp duty value. The appellant contended that the agreement for sale of section of property was done in 2012. Hence, Section 56(2)(vii) is not applicable in his case. In my view, The Section 56(2)(vii) does not consider the date of the agreement but rather focuses on the amount received in consideration. This is an important distinction, and it suggests that the tax implications is based on the actual amount received rather than the agreed-upon value in the agreement.”

Because the Ld. CIT(A) has erred in law in quoting the section correctly where the applicable section in this case may be section 56(2)(vii)(b), instead of, as quoted above 56(2)(vii). Also, the Ld. CIT(A) erred in correctly interpreting and appreciating the provisions of section 56(2)(vii)(b), The first proviso to section 56(2)(vii)(b) focusses merely on value adopted and assessed by stamp authority as actual consideration amount, where the date of agreement and date of registration are different, provided any amount other than cash has been paid on or before the date of agreement, the details of payment up to date of agreement are enclosed in chart attached.

8. Because the CIT(A) has failed to appreciate that the appellant had requested to refer the property to the Valuation Officer in terms of proviso to section 56(2)(vii)(b)/50C(2) of the Act and that having not been done by the AO, the addition made Is contrary to the provisions of the Act, the addition made be deleted

9. Because the CIT(A) has erred on facts and in law in upholding the addition of Rs. 49,11,947/- as short term capital gains being the difference between the actual consideration received and stamp value as adopted in respect of the part property sold, such addition being contrary to facts bad in law be deleted.

10. Because no consequential or parallel action of treating the difference between the actual consideration paid and received, in the hands of the seller, the AO was not justified in treating the difference in the hands of the assessee as income, the CIT(A) has erred on facts and in law in upholding the addition made by the AO, the same be deleted.

11. Because on a proper consideration of the facts and circumstances of the case and on interpretation of the provisions of the Act, the addition made by the AO and upheld by the CIT(A) applying the provisions of section 56(2)(vii)(b) and 50C, is not maintainable both on facts and in law, the same be delete.

12. Because in any case and all circumstances the additions made by the AO and upheld by the CIT(A), be deleted.

13. Because on a proper appraisal of the facts of the case, the order passed by the AO and upheld by the CIT(A) is all against the principles of natural justice and be quashed.”

3. In this case, the assessee had filed the return of income on 30/09/2014, showing total income of Rs.7,81,320/-. Subsequently, notice dated 30/03/2021 was issued u/s 148 of the Act, in compliance whereof the assessee again filed income tax return on 22/04/2021; declaring income of Rs.7,81,320/-again. Vide assessment order dated 30/03/2022 passed u/s 147 r.w.s 144B of the Act, the assessee’s total income was assessed at Rs.2,71,15,320/-. In the aforesaid assessment order, an addition of Rs.2,14,22,053/- was made u/s 56(2)(vii)(b) of the Act and an addition of Rs.49,11,947/- was made towards Short Term Capital Gain (STCG). The aforesaid additions have been made by the Assessing Officer (“AO”), in respect of transactions in immovable property. The assessee and his wife Mrs Anita Singh purchased an immovable property from Shri Gurinder Pal Singh for consideration of Rs.2,19,40,000/- as against the Stamp Duty Valuation of the property at Rs.4,82,74,000/-. A part of this property was sold to Shri Sunil Kumar Mishra for a sale consideration of Rs.40 Lakh as against the Stamp Duty Valuation of Rs.89,11,947/-. The AO adopted the Stamp Duty Valuation for the aforesaid transactions which resulted in the aforesaid additions of Rs.2,14,22,053/- and Rs. Rs.49,11,947/-. Aggrieved, the assessee filed an appeal in the office of the Ld. CIT(A) vide impugned appellate order dated 03/01/2024, the assessee’s appeal was dismissed. The relevant portion of the order of the Ld. CIT(A) is reproduced as under: –

“4.1 Appeal Notices were issued to the assessee on 03.08.2022, 31.08.2022, 03.11.2023 fixing the case for 18.08.2022, 15.09.2022, 20.11.2023. The assessee has replied on 22.10.2022, 29.10.2022, 31.10.2022, 01.11.2022, 16.12.2023.

4.2 The first ground taken by the assessee is that the Ld. Assessing Officer erred in law and on facts in completing the assessment taking full value of consideration at Rs. 4,82,74,000/- and making addition of Rs. 2,14,22,053/- without referring the matter to DVO for determination of Fair Market Value and ignoring my request made and the second main ground taken by the assessee is that the Ld. Assessing Officer erred in law and on facts in making addition under section 50C-STCG of Rs. 49,11,947/- without referring the matter to DVO for determination of Fair Market Value and ignoring my request made

4.3 I have gone through the assessment order and record available. In the instant case, Mr. Nirmal Singh and his wife Mrs. Anita Singh purchased property below its stamp valuation during the previous year 2013-14. The case was reopened the case under section 147, for undisclosed income. Mr. Nirmal Singh declared an income of Rs. 7,81,320/-, which the department found inconsistent with the property transaction details. The property was purchased for Rs. 2,19,40,000/-against a stamp valuation of Rs. 4,82,74,000/-. A part was later sold for Rs. 40 Lakh. Sections 56(2)(vii) and 50C of the Income Tax Act are deemed applicable to this transaction. The case was reassessed under section 147, and a notice under section 148 was issued. The reassessment led to an addition of Rs. 2,14,22,053/- under section 56(2)(vii) and Rs. 49,11,947/- under section 50C, treated as escaped income. The reassessment, being a result of what the AO considers concealed particulars of income, led to the initiation of penalty proceedings under section 271(1)(c) of the Act. The assessee submitted a response to the show cause, citing various judicial decisions in support of its claims. The assessee requested a personal hearing through video conferencing, which the department scheduled but the assessee failed to attend. The department, after considering the reply and absence of the assessee during the scheduled hearing, rejected the claims made by the assessee. The total assessed income, including additions, is determined to be Rs. 2,71,15,320/-.

4.4 As regards first ground is concerned that during the appeal proceedings, the appellant has claimed the purchase of Kartar Talkies as being acquired through a “slump sale.” The contention mentioned in appeal but this claim was not disputed before the Assessing Officer (AO). It implies that, during the assessment process, there was no disagreement or challenge to the appellant’s assertion regarding the nature of the purchase. However, the statement is not substantiated as, no evidence supporting the slump sale claim has been submitted during the appeal proceedings. This lack of evidence is challenging because it is necessary to substantiate such claims, especially if they have significant implications for income tax. it’s crucial to provide proper documentation and evidence to support any such claim made. The absence of evidence to support the slump sale claim during the appeal proceedings has weaken the case of the assessee. The appellant has failed to give evidence regarding the fact that the sale of Kartar Talkies was a slump sale and the value of such assets in the books of seller. The documents could include relevant agreements, financial statements, or any other records that demonstrate the nature of the transaction. Since there is no such evidence submitted by assessee. Hence, the ground is dismissed.

4.5 As regards, in the next ground, the sale at a low consideration is concerned. The AO has invoked Section 56(2)(vii). This section pertains to the tax implications of transactions where immovable property is transferred for a consideration less than its stamp duty value. «The appellant contended that the agreement for sale of section of property was done in 2012. Hence, Section 56(2)(vii) is nat applicable in his case. In my view, The Section 56(2)(vii) does not consider the date of the agreement but rather focuses on the amount received in consideration. This is an important distinction, and it suggests that the tax implications is based on the actual amount received rather than the agreed-upon value in the agreement. The low consideration in the sale, was not disputed before the AO, the provisions of Section 56(2)(vii) should be considered based on the actual amount received. In this case, the appellant is relying on Section 56(2)(vii) and the actual amount received, but has not submitted documents supporting this claim during the appeal proceedings. In view of the above discussion, the ground taken by the assessee is dismissed.”

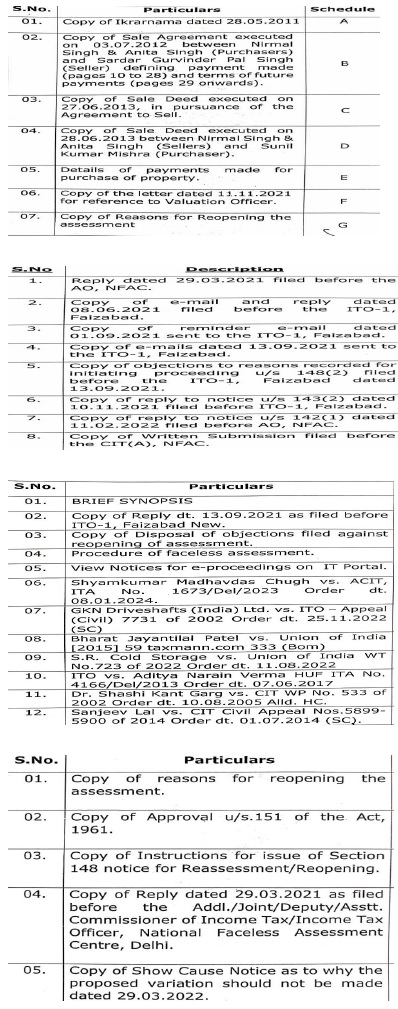

4. Aggrieved again, the assessee filed an appeal in Income Tax Appellate Tribunal (ITAT). In the course of appellate proceedings in ITAT, the assessee filed paper book in three parts containing the following particulars: –

5. At the time of hearing before us, the assessee was represented by Shri Rakesh Garg, Learned Counsel; and Revenue was represented by Shri Sanjeev Krishna Sharma, Sr. Departmental Representative. Both sides filed written submissions. The relevant portion of the written submission filed from the assessee’s side is reproduced as under: –

“Proceedings u/s.148 initiated are not valid –

Reasons: (i) The reasons as recorded are factually incorrect.

(ii) The reasons as recorded do not contain the material on the basis of which such reasons have been formulated.

(iii) It is the case of borrowed satisfaction.

(iv) No application or appreciation or analysis of facts.

(v) No independent inquiry by the AO prior to issue of notice u/s.148.

(vi) The Approval given by the competent authority is mechanical. Giving approval on the basis of wrong facts and incorrect quote of section.

(vii) The Assessment framed is without jurisdiction. No notice has been issued u/s.143(2) by the NFAC. The sec. 144B is mandatory. Notice ought to have been issued by NFAC. In absence of notice the NFAC does not assume jurisdiction. No notice u/s.143(2) can be issued prior to disposal of objections.

(viii) Non disposal of objections as filed to reasons as provided u/s.148. Delayed disposal of objection violate the law as laid down by the Apex Court. The objections have been disposed off the same day as the order has been passed.

(ix) Draft assessment order passed on 29.03.2022. Objection invited on 29.03.2022 itself. Time allowed till 30.03.2022. Objections filed not considered in sufficient time. Lack of reasonable time. Principles of natural justice violated.

(f) On Merits:

i. Agreement to sale entered upon much earlier. Registered agreement. Payment made. Value to be adopted as per the ATS.

ii. Reference to Valuation Officer not made. Request made on 10.11.2021.

iii. Property jointly purchased, entire addition made in the hands of the assessee.”

6. The relevant portion of written submission of the Ld. Sr. Departmental Representative for the Revenue is reproduced as under: –

“A. Technical Issues:

The objection of the Ld. A/R on the issue of notice u/s 148 is not valid in view of following narration of relevant facts by AO in the Assessment Order :

“………. 2. As per the information available with the Department the Mr. Nirmal Sing along with his wife Mrs. Anita Singh has purchased an immovable property from Shri Gurinder Pal Singh for consideration of Rs. 2,19,40,000 against the stamp value of the property at Rs.4,82,74,000/- during the FY 2013-14. As the property is purchased below the stamp valuation, Section 56(2)(vii) of the Act is attracted …Also, assessee has sold the part of property of stamp valuation of Rs 89,11,947/- for consideration of Rs.40 Lakh to Shri Sunil Kumar Mishra. Hence, provision of Sec.50C is applicable on Shri Nirmal Singh for this transaction and chargeable to tax under the head Capital Gains.

3. However, as per the records of the department, it was noticed that the assessee has filed his ITR for the year under consideration declaring income of Rs.7,81,320/-. The Income declared by the assessee does not commensurate with the alleged transaction. These material facts were not fully and truly disclosed by assessee in the return of income and therefore the source of above mentioned transaction by the Assessee remains unexplained.

4. Therefore, the case was reopened under section 147 of the Act by recording reasons and satisfaction and obtaining approval of the competent Accordingly, a notice under section 148 of the Act was issued and served digitally to the assessee on 30.03.2021 requesting the assessee to deliver his ITR within 30 days of receipt of the notice. The assessee has filed ITR in response to the notice u/s 148 of the Act on 22.04.2021 declaring income of Rs.7,81,320/- same as declared in original return income of filed. The notice us 143(2) was issued on 27.10 2021………….. Thereafter, the case was assigned to the National Faceless Assessment Centre(NFAC) on 11.11.2021 under the Faceless Assessment Scheme, 2019…. ”

The objection of the Ld. A R on the issue of notice u s 143(2) by the successor i.e. AO NeFAC is also not valid in view of the Le: al Provisions of Section 129 & Section 292 BB which are being reproduced hereunder:

Change of incumbent of an office

129 “Whenever in respect of any proceeding under this Act an income-tax authorities ceases to exercise jurisdiction and is succeeded by another who has and exercise jurisdiction the income tax authority so succeeding may continue from the stage at which the proceeding was left by his predecessor….”

Notice deemed to be valid in certain circumstances.

292BB “Where an assessee has appeared in any proceeding or cooperated in any inquiry relating to an assessment or reassessment it shall be deemed that an notice under any provision of this Act which is required to be served upon him has been duly served upon him in time in accordance with the provisions of this Act and such assessee shall be precluded from taking any objection in any proceeding or inquiry under this Act that the notice was —

(a) not served upon him; or

(b) not served upon him in time; or

(c) served upon him in an improper manner: ”

In view of the above, the technical objections raised by the Ld. A/R are not valid.

B. Factual Issues:

In the interest of justice, it is important to have a look upon the facts narrated by Ld. AO & Ld. CIT (A) in Asstt. Order & Appellate Order respectively, which are being reproduced hereunder:

Assessment Order:

“…… 6, The assessee has submitted his response alongwith the details called for vide notices issued. The assessee has submitted the purchase deed of the property, sale deed of the property, photos of the property, financial statements, bank account statement.

7. The reply submitted by the assessee is verified and found to be not tenable and not convincing and the claim of the assessee that sec. 56(2)(vii)(b) and sec.50C will not be applicable is rejected it is observed that the agreement price of the.. purchased property was Rs.2.19,40,000/- whereas the stamp value of the property Was Rs.4,82,74,000 1.9 the difference is of Rs.2,63,34,000 on which sec. 56(2)(vii)(b) is applicable Out of the same property, portion of the property was sold to Sunil Kumar at agreement price of Rs. 40,00,000/- however the stamp value of the property was Rs.89,11,947/- and hence, section 50C of the Act is applicable on Rs.49,11,947/-. Therefore, the purchase of property of Rs.4,82,74,000 (stamp value) in Rs.2,19,40,000/during year under consideration is concerned, application of sec. 56(2)(vii) (b) is applicable.

But, the amount of Rs.49,11,947/- is to be deducted from the difference in the value between the sale purchase of the property i.e. Rs.2,63,34,000/- and from this amount Rs.49,11,947/- is deducted in order to justifiably assess the amount of difference i.e. Rs.2,14,22,053/- (Rs.2,63,34,000 minus Rs.49,11,947) is treated as escaped income within the provision of sec.56(2)(vii)(b) of the Act and added back to the total income under the head income from other sources………

…….. 9. The assessee in response to the show cause has submitted his reply dt. 29.03.2022 placing his stand on the additions proposed in the show cause and quoted various judicial decisions in support of his claim. Further the assessee requested for a personal hearing through video conferencing for oral submission of information…

… The reply submitted by the assessee in response to the show cause is perused and found to be not tenable as the assessee was required to provide the details of Stamp Value of the property as per the stamp valuation authority for the agreement done on 03/07/2012 during the F.Y. 2012-13, however the assessee has failed to submit those details,

Further, the assessee was given a opportunity of personal hearing through video conferencing for presenting his stand and oral submission of information as per the request made by him However, the assessee failed to attend the Video Conference scheduled on 30/03/2022 at 3.15 P.M. Therefore the claim of the assessee is hereby rejected…. ”

Appellate Order :

“……… 4.1 Appeal Notices were issued to the assessee on 03.08.2022, 31.08.2022, 03.11.2023 fixing the case for 18.08.2022, 15.09.2022, 20.11.2023. The assessee has replied on 22.10.2022, 29.10.2022, 31.10.2022, 01.11.2022, 16.12.2023.

4.2 The first ground taken by the assessee is that the Ld. Assessing Officer erred in law and on facts in completing the assessment taking full value of consideration at Rs 4,82,74,000/- and making addition of Rs 2,14,22,053/-without referring the matter to DVO for determination

of Fair Market Value…………. and the second main ground taken by the

assessee is that the Ld. Assessing Officer erred in law and on facts in making addition under section 50C-STCG of RS 49,11,947/- without referring the matter to DVO for determination of Fair Market Value and ignoring my request made

4.3 I have gone through the assessment order and record available. In the instant case, Mr. Nirmal Singh and his wife Mrs. Anita Singh purchased property below its stamp valuation during the previous year 2013-14, The case was reopened the case under section 147, for undisclosed income. Mr. Nirmal Singh declared an income of Rs.7,81,320/-, which the department found inconsistent with the property transaction details. The property was purchased for Rs. 2,19,40,000/against a stamp valuation of Rs.4,82,74,000/-. A part was later sold for Rs.40 Lakh Sections 56(2)(vii) and 50C of the Income Tax Act are deemed applicable to this transaction.

The case was reassessed under section 147, and a notice under section 148 was issued. The reassessment led to an addition of Rs.2,14,22,053/- under section 56(2)(vii) and Rs.49,11,947/- under section SOC, treated as escaped income. The reassessment, being a result of what the AO considers concealed particulars of income, led to the initiation of penalty proceedings under section 271(1)(c) of the Act. The assessee submitted a response to the show cause, citing various judicial decisions in support of its claims. The assessee requested a personal hearing through video conferencing, which the department scheduled but the assessee failed to attend. The department, after considering the reply and absence of the assessee during the scheduled hearing, rejected the claims made by the assessee. The total assessed income, including additions, is determined to be Rs.2,71,15,320/-.

4.4. As regards first ground is concerned that during the appeal proceedings, the appellant has claimed the purchase of Kartar Talkies as being acquired through a “slump sale”. The contention mentioned in appeal but this claim was not disputed before the Assessing Officer (AO). It implies that, during the assessment process, there was no disagreement or challenge to the appellant’s assertion regarding the nature of the purchase. However, the statement is not substantiated as, no evidence supporting the slump sale claim has been submitted during the appeal proceedings. This lack of evidence is challenging because it is necessary to substantiate such claims, especially if they have significant implications for income tax. it’s crucial to provide proper documentation and evidence to support any such claim made. The absence of evidence to support the slump sale claim during the appeal proceedings has weaken the case of the assessee. The appellant has failed to give evidence regarding the fact that the sale of Kartar Talkies was a slump sale and the value of such assets in the books of seller. The documents could include relevant agreements, financial statements, or any other records that demonstrate the nature of the transaction. Since there is no such evidence submitted by assessee. Hence, the ground is dismissed.

4.5 As regards, in the next ground, the sale at a low consideration is concerned. The AO has invoked Section 56(2) (vii). This section pertains to the tax implications of transactions where Immovable property is transferred for a consideration less than its stamp duty value. The appellant contended that the agreement for sale of section of property was done in 2012. Hence, Section 56(2)(vii) is not applicable in his case. In my view, The Section 56(2)(vii) does not consider the date of the agreement but rather focuses on the amount received in consideration. This is an important distinction, and it suggests that the tax implications is based on the actual amount received rather than the agreed-upon value in the agreement. The low consideration in the sale, was not disputed before the AO, the provisions of “Section 56(2)(vii) should be considered based on the actual amount received. In this case, the appellant is relying on Section 56(2) (vii) and the actual amount received, but has not submitted documents supporting this claim during the appeal proceedings. In view of the above discussion, the ground taken by the assessee is dismissed.

5. As a result, the appeal is dismissed…………. ”

Sufficient Opportunity to the Assessee

As is clear from the above, sufficient opportunity of being heard has already been availed by the asseessee during the course of Assessment and Appellate proceedings. Therefore, it is humbly requested that any Additional Evidence submitted by the assessee may kindly Not be considered at this stage please. It is also important to mention that “Iqrarnama” of FY 2011-12 (as submitted by assessee) is not an admissible evidence as the same is signed by the assessee’s wife and, moreover, it does not specify any amount as “Proposed Sale Consideration”. Regarding assessee’s claim of Sale Agreement during FY 2012-13, the AO has observed as under :

“……… the assessee was required to provide the details of Stamp Value of the property as per the stamp valuation authority for the agreement done on 03/07/2012 during the F.Y. 2012-13, however the assessee has failed to submit those details…”

3. In view of the above, it is humbly requested that, in the interest of justice, the judicious verdicts of Ld. CIT (Appeal) in the above cases may kindly be upheld. However, in the esteemed opinion of Hon’ble Bench, if any fact has been left to be verified by the AO or Ld. CIT (A), the matter can be restored back to the respective authority for verification of facts in the interest of justice.”

7. At the time of hearing before us, the Learned Counsel for the Assessee placed reliance on the aforesaid written submissions and paper books. He placed special reliance on order of the Delhi Bench of ITAT, in the case of ITO Vs. M/s. Aditya Narain Verma (HUF) (Vide order dated 07/06/2017 in ITA. No.4166/Del/2013 for AY. 2009-10). He also placed reliance on brief synopsis (forming part of paper book), the relevant portion of which is reproduced as under: –

“(i) The property has been purchased in the joint names of Nirmal Singh and Smt. Anita Singh.

(ii) The entire addition has been made in the hands of Nirmal Singh. The agreement to purchase and Sale Deed in in the joint names.

(iii) The description of the property in question is in the sale agreement as well as sale deed.

(iv) The first payment was made on 10.03.2011. Agreement executed and Notarized on 28.05.2011.

(v) Registered agreement to purchase the property executed on 03.07.2012. The purchase consideration is Rs.2,19,40,000/- An amount of Rs.84,41,000/- had been paid as advance upto the date of agreement and the remaining amount has been paid thereafter.

(vi) The agreement has been entered upon. The consideration as per the purchase agreement should be adopted for consideration and amount the stamp value. Proviso to section 56(2)(vii)(b) & Section 50C(2).

(vii) The sale deed executed on 26.06.2013.

(viii) Section 56(2)(vii)(b) Proviso is applicable and as per same the date of first payment i.e. 10.03.2011 would construe to be the date of agreement/transaction. The agreement to purchase is to be taken as on 10.03.2011 and is prior to insertion of section 56(2)(vii)(b), which was inserted w.e.f. 01.04.2014, FA 2013, hence not applicable.

Since the liability to tax arises in the A.Y. 2011-12 and 2012-13 the proceedings initiated u/s.147/148 become without jurisdiction for the year. Value as per the Agreement to sell (dt. 15.03.2011 verbal/03.07.2012 Registered) to be taken for the purposes of computation of capital gains.

(i) Shyamkumar Madhavdas Chugh vs. ACIT ITA No.1673/Del/2023 Order dt. 08.01.2024 (attached)

(ii) Pramatha Ranjan Biswas vs. DCIT [2023] 148 com.208 (Raipur-Trib. )

(iii) Prakash Chand Bethala vs. DCIT ITA No. 999/Bangalore/2019 Order dt. 28.01.2021

(iv) N A Haris vs. Addl.CIT (Bangalore) ITA No. 988/Bang/2018 Order dt. 15.02.2021.

(ix) Reference to Valuation Officer requested vide letter dated 11.11.2021 but no reference made.

(x) The reassessment is invalid. The section mentioned is 56(2)(vii) and not (vii)(b). No approval as mandated u/s.151. Mechanical Approval. Had the competent authority read the reasons, he would have at least noted the wrong section as mentioned.

(xi) No notice u/s.144B(1) as mandated.

| > Return Filed on | 30.09.2014 |

| > income Declared | Rs.7,81,320/ |

| > Return Processed U/s.143(1) on | 13.03.2015 |

| > Notice u/s.148 dt. | 30.03.2021 digitally served. |

| > Return filed on | 22.04.2021 |

| > Objection to notice | 13.09.2021 (attached) |

| u/s.148 filed on

Notice u/s.143(2) on |

27.10.2021 |

| > Case assigned to NFAC on | 11.11.2022 |

> Copy of order dated 29.03.2022 disposing off the objections is attached. Objections to the proceedings initiated u/s.148 filed on 13.09.2021. – Not disposed off within reasonable time but disposed off on 29.03.2022, a day before the passing of the final Assessment Order. Not permitted –

(i) GKN Driveshaft (India)Ltd. vs. CIT 259 ITR 19 (SC) (attached) (ii) Bharat Jayantilal Patel vs. UOI – 378 ITR 596 (Bombay) (attached)

> Response filed to Notices as issued u/s.142(1) from time to time.

> No Notice u/s.143(2) issued by NFAC as required as per section 144B(1) of the Act.

> Issue of Notice u/s.143(2) by NFAC is sine qua non. Any assessment framed without issue of notice u/s.143(2) by NFAC, makes the order passed by NFAC © and without jurisdiction.

> The reason for this, itself has been laid down in the procedure for Faceless Assessment (copy attached). It states as to how an assessee would come to know that his case has been picked up for faceless e-assessment. The answer to the same is that an assessee shall receive notice u/s.143(2) of the Act digitally signed by NeAC Office in its registered account with e-filing (www. Incometaxefilingindia.gov.in) followed by real time alert in the form of an sms and/or email.

Section 144B(1) stated that notice u/s 143(2) shall be issued by the NFAC. No notice u/s.143(2) has been issued by NFAC. The moment the jurisdiction over the case is transferred to NFAC, the provisions of section 144B becomes operative.

(xii) As submitted, above, sub-section 144B(1) lays down that a notice u/s.143(2) is to be issued. Notice u/s.143(2) is a jurisdictional notice. Without issue of notice u/s.143(2) the NFAC does not assume jurisdiction. Failure to issue the notice u/s.143(2) does not authorize NFAC to proceed with the assessment. Issue of notice is sine qua non. The present assessment has become jurisdiction less. It is an incurable disease and no radiation can heal the ailment.

(xiii) Request for personal hearing sought for on 29.03.2022. Granted the same day. No reasonable opportunity allowed. Reliance be placed on the decision of Allahabad High Court in the case of S R Cold Storage vs. UOI & othrs. Writ Tax No. 723 of 2022. Order dated 11.08.2022. (attached)

(xiv) Draft Order dt. 29.03.2022 SCN _ for 29.03.2023 itself, final order passed on 30.03.2022. No reasonable opportunity allowed. Proceedings become illegal.

(xv) The manner in which the things are to be done is to be strictly followed. Any deviation would make the proceedings illegal –

(i) Shashi Kant Garg vs. CIT 285 ITR 158 (Alld.) (attached)

(ii) Aditya Narain Verma vs. DCIT ITA No.4166/Del/2013. (attached)

(xvi) Liability to pay capital gains tax arises in the year when the agreement to sell was executed –

(i) Sanjeev Lal vs. CIT Chandigarh – Civil Appeal No. 5899-5900 of 2014 Order dt. 01.07.2014. (attached).”

8. We have heard both sides. We have perused the materials available on records. It is not in dispute that vide letter dated 11/11/2021, the assessee requested for reference to Valuation Officer for determination of fair market value of the property purchased by the assessee and the property sold by the assessee. The provisions of Section 50C(2) of the Act as well as proviso to Section 56(2)(vii)(b) of the Act; mandate reference by the Assessing Officer to the Valuation Officer when the assessee claims before the Assessing Officer that the value adopted or assessed or assessable Stamp Valuation Authority exceeds the fair market value of the property as on the date of transfer. It is also not in dispute that the Assessing Officer failed to make reference to Valuation Officer, as mandated by the aforementioned provisions of law. In this regard, we find that the issue is squarely covered in favour of the assessee by order of Co-ordinate Bench of ITAT Delhi in the case of ITO Vs. M/s. Aditya Narain Verma (HUF) (supra). In this case, the request of the Departmental Representative that the matter may be set aside to the file of the Assessing Officer for referring the case to Valuation Officer, was rejected. The relevant portion of the order is reproduced as under: –

“4.1 On the very perusal of the provisions laid down under section 50C of the Act reproduced hereinabove, we fully concur with the finding of the ld. CIT (Appeals) that when the assessee in the present case had – claimed before Assessing Officer that the value adopted or assessed by the stamp valuation authority under sub section (1) exceeds the fair market value of the property as on the date of transfer, the Assessing Officer should have referred the valuation of the capital asset to a valuation officer instead of adopting the value taken by the state authority for the purpose of stamp duty. The very purpose of the Legislature behind the provisions laid down under sub section (2) to section 50C of the Act is that a valuation officer is an expert of the subject for such valuation and is certainly in a better position than the Assessing Officer to determine the valuation. Thus, non-compliance of the provisions laid down under sub section (2) by the Assessing Officer cannot be held valid and justified. The Hon’ble’ jurisdictional High Court of Allahabad in the case of Shashi Kant Garg (supra) has been pleased to hold that it is well settled that if under the provisions of the Act an authority is required to exercise powers or to do an act in a particular manner, then Bat power has to be exercised and the act has to be performed in that manner alone and not in any other manner. Similar view has been expressed by the other decisions cited by the Ld. AR in this regard hereinabove. The first appellate order on the issue is thus upheld. The grounds are accordingly rejected.”

9. Respectfully following the aforesaid order of Delhi Bench of ITAT of Delhi in the case of ITO Vs. M/s. Aditya Narain Verma (HUF) (supra), we hold that the additions made by the Assessing Officer amounting to Rs.2,14,22,053/- and Rs.49,11,947/-, as aforesaid, without reference to the Valuation Officer as mandated by law, has no legs to stand and is unsustainable; having regard to applicable law as well as facts and circumstances of the present case before us. Accordingly, we set aside the impugned appellate order dated 03/01/2024 of the Ld. CIT(A) and we direct the Assessing Officer to delete the aforesaid additions of Rs. 2,14,22,053 and Rs. Rs.49,11,947/-.

10. Since we have already directed the Assessing Officer to delete the aforesaid additions of Rs. 2,14,22,053 and Rs. Rs.49,11,947/-, the remaining arguments advanced by both sides are merely academic in nature and need not to be adjudicated.

In the result, the appeal of the assessee is allowed. Stay Application No. 07/LKW/2024

11. Since we have already disposed of the aforesaid appeal of the assessee vide ITA. No.83/LKW/2024, the Stay Application filed by the assessee vide S.A. No. 07/LKW/2024 has become infructuous. Accordingly, the stay application is dismissed being infructuous.

12. In the result, the appeal of the assessee is allowed and the stay application filed by the assessee is dismissed being infructuous.

Order pronounced in the open Court on 10/10/2024.